Free Money Saving Printables

Saving money is a goal that many of us want to achieve. Whether you're looking to build an emergency fund, pay off debt, or save for a big purchase, having the right tools and strategies in place can make a significant difference. We have created a collection of printables that can help you on your money-saving journey. From challenges to expense reduction and budgeting, these resources will help you to take control of your finances and work towards your financial goals.

Saving Money Challenges

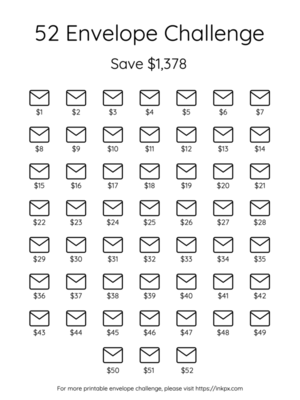

Envelope Challenge Printables

The envelope challenge is a popular method for saving money. It involves allocating a specific amount of cash into envelopes designated for different purposes, such as travels, entertainment, or transportation. The envelope challenge printables provide a visual representation of your savings goals and help you stay accountable by tracking your progress as you fill each envelope.

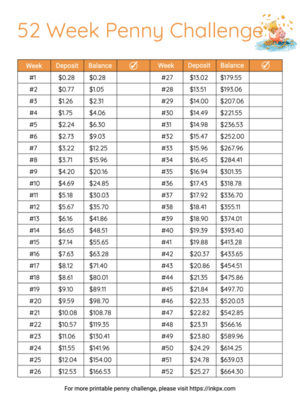

Penny Challenge

The penny challenge is a fun and simple way to save money over time. The concept is straightforward: you save one penny on the first day, two pennies on the second day, and so on, until you reach 365 days. By the end of the year, you will have accumulated a significant sum of money. The penny challenge printable serves as a visual aid, allowing you to check off each day as you contribute to your savings.

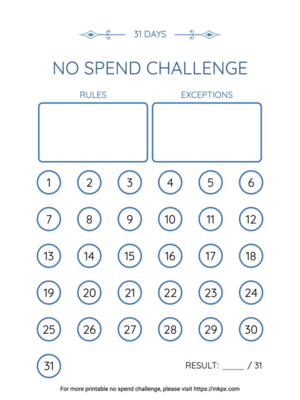

No Spend Challenge

The no spend challenge is an excellent way to reset your spending habits and identify areas where you can cut back. By committing to a period of time during which you refrain from non-essential purchases, you can save a substantial amount of money. The no spend challenge printable helps you stay motivated and accountable by tracking your progress and celebrating each day that you successfully avoid unnecessary expenses.

Reducing Expenses

Meal Planner

One of the most effective ways to save money is by planning your meals in advance. The meal planner printable allows you to create a weekly or monthly menu, taking into account your dietary preferences and nutritional goals. By planning your meals, you can make a shopping list of only the necessary ingredients, avoiding impulse purchases and reducing food waste. This not only saves you money but also promotes healthier eating habits.

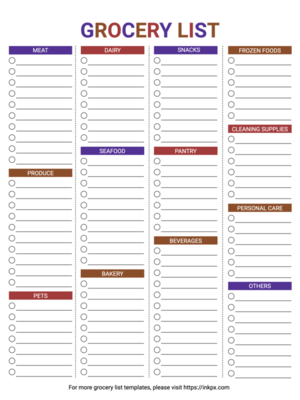

Grocery List Templates

Creating a grocery list before heading to the store is a tried-and-true method for avoiding unnecessary purchases. The grocery list templates provide a structured format for organizing your shopping items, ensuring that you only buy what you need. By sticking to your list, you can resist the temptation of impulse buys and stay focused on your budget.

Subscription Tracker

In today's digital age, it's easy to accumulate various subscriptions that can drain your finances without you even realizing it. The subscription tracker printable allows you to list all your subscriptions, along with their costs and renewal dates. This visual overview enables you to evaluate which subscriptions are essential and which ones you can cancel or downgrade, helping you reduce unnecessary expenses.

Bill Tracker Templates

Late payment fees can quickly add up and throw your budget off track. The bill tracker templates help you stay organized by providing a dedicated space to record your bills and their due dates. By keeping track of your payments, you can ensure that you never miss a deadline, avoid late fees, and maintain a good credit score.

Budgeting

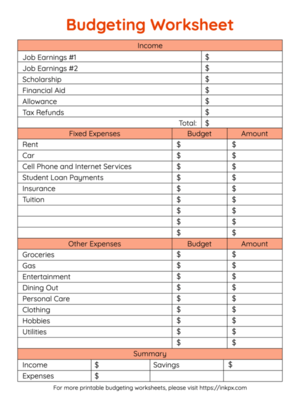

Budgeting Worksheets

Budgeting is a fundamental aspect of financial management. The budgeting worksheets provide a comprehensive framework for tracking your income, expenses, and savings goals. By categorizing your spending and comparing it to your income, you can identify areas where you can cut back and allocate more funds towards savings or debt repayments. These worksheets serve as a roadmap for achieving financial stability.

Expense Tracker

Understanding your daily, weekly, or monthly spending patterns is crucial for effective budgeting. The expense tracker printable allows you to record and categorize your expenses, providing insights into your spending habits. By visualizing where your money goes, you can make informed decisions about reducing discretionary expenses and reallocating those funds towards your financial goals.

Debt Tracker

Paying off debt requires discipline and a clear plan. The debt tracker printable helps you monitor your debts, including balances, interest rates, and payment deadlines. By visualizing your progress, you can stay motivated and track your journey towards becoming debt-free. This tool empowers you to create a payoff strategy and make extra payments where possible, accelerating your debt repayment process.

Printable Sinking Funds Tracker

A sinking funds tracker is a smart tool to keep your savings goals on track. It lets you set money aside for specific expenses over time. By breaking down big expenses into smaller, manageable chunks, it makes saving less overwhelming. With this tracker, you clearly know how much you've saved, how much you need, and how your savings grow over time. It's like a GPS for your finances, guiding you toward your financial targets without getting lost. Using a sinking funds tracker can prevent last-minute financial stress and help you smoothly reach your savings goals.

Savings Trackers

Saving money is an essential part of any financial plan. The savings tracker printouts allow you to set savings goals and monitor your progress over time. Whether you're saving for a vacation, an emergency fund, or a down payment on a house, these trackers serve as a visual reminder of your objectives and encourage you to stay on track.

Income Tracker

Tracking your income is just as important as monitoring your expenses. The income tracker printable enables you to record all sources of income, including salaries, side hustles, or passive income streams. By tracking your earnings, you can evaluate your cash flow, set realistic savings goals, and make informed decisions about your financial priorities.

Goal TrackingTemplates and Charts

Setting specific financial goals is crucial for staying motivated and focused on your saving journey. The goal tracking templates and charts provide a visual representation of your goals and allow you to track your progress over time. Whether you're aiming to save a certain amount of money, pay off a debt, or achieve a milestone in your financial plan, these tools help you stay accountable and celebrate your successes along the way.

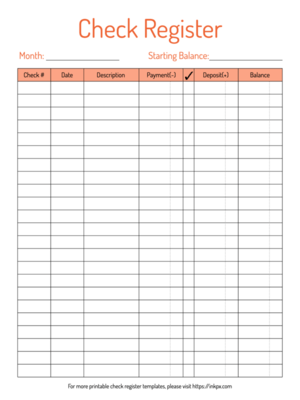

Check Register

By diligently recording all of your financial transactions, including deposits, withdrawals, and expenses, in a check register, you gain a comprehensive view of your income and expenses. This allows you to track your spending patterns and identify areas where you can make adjustments to save money. The act of manually writing down each transaction also encourages mindfulness about your spending habits, as you become more aware of how much money is flowing in and out of your accounts. With a check register, you can easily monitor your progress towards your financial goals and make informed decisions about where to cut back or allocate more funds. Additionally, a check register can help prevent overspending and overdrawing from your accounts, as you can keep a close eye on your available balance.

These printables offer a variety of tools and resources to help you save money, reduce expenses, and budget effectively. By incorporating these printables into your financial routine, you can gain better control over your finances, make informed decisions about your spending, and work towards achieving your long-term financial goals. Remember, financial success is a journey, and these printables are here to guide and support you every step of the way. Happy saving!