Penny Challenge

Download our customizable printable penny challenge templates in PDF, PNG, or JPG formats. Choose your preferred font, colors, and add or remove text as desired. Available in A4 or US Letter size, these templates are perfect for tracking your progress as you save those extra pennies. Start the challenge today and watch your savings grow.

What is the Penny Challenge?

The penny challenge is a popular money-saving strategy that involves setting aside a small amount of money each day, week, or month. By starting with just a penny and incrementally increasing the amount, participants can accumulate significant savings over time. This approach promotes consistency, discipline, and financial awareness.

Types of Penny Challenge Templates

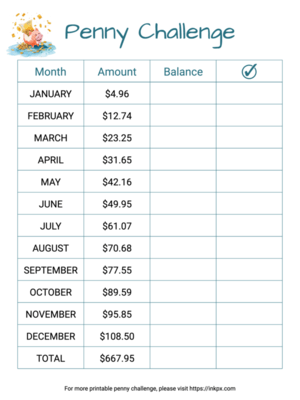

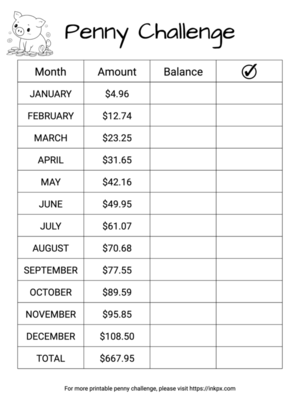

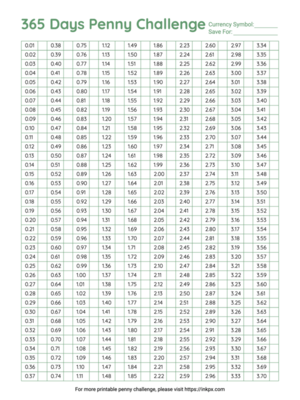

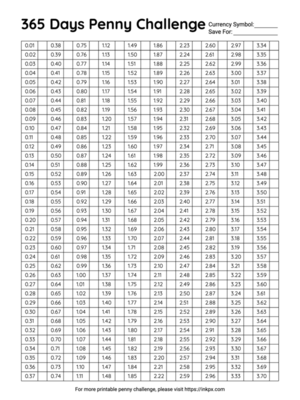

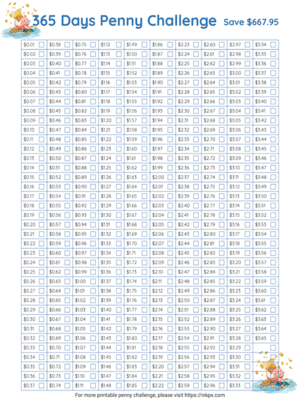

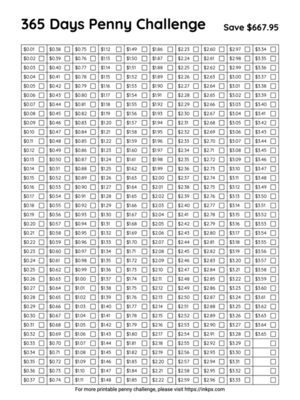

365-Day Penny Challenge - Save up to $667.95 in 365 days.

In this challenge, you save a specific amount of money corresponding to the day of the year. For example, on the first day, you save $0.01, on the second day $0.02, and so on. By the end of the year, you will have accumulated a total of $667.95.

-

This challenge allows you to save a designated amount each month, gradually increasing over time. Start by saving $4.96 in the first month, $12.74 in the second month, and continue until the 12th month, where you save $108.5. The total savings in this template amount to $667.95.

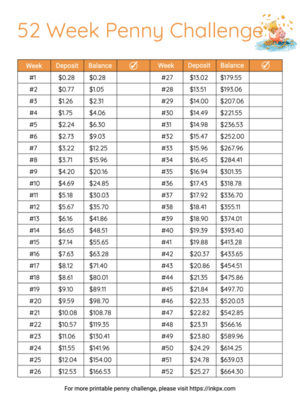

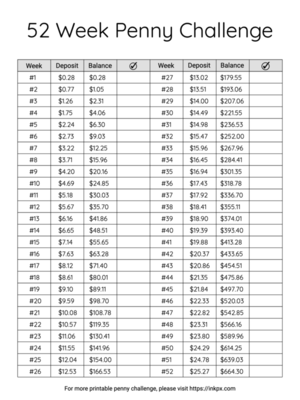

52-Week Penny Challenge - Save up to $664.30 in 52 weeks

With this template, you save a fixed amount each week, beginning with $0.28 in the first week and gradually increasing the amount each subsequent week. By the end of the 52 weeks, you will have saved $664.30.

How to Start the Penny Challenge

- Set Clear Goals: Determine the amount you wish to save and select the appropriate template according to your financial goals and saving preferences. Our templates are easy to edit, so feel free to make modifications before downloading and printing.

- Choose Your Timeline: Decide whether you prefer a daily, weekly, or monthly saving routine. Assess your financial situation and select the timeline that aligns best with your income and budget.

- Create a Dedicated Savings Container: Designate a specific jar, piggy bank, or savings account to store your accumulated savings. Having a visual representation of your progress can serve as a motivator.

- Establish a Routine: Make saving a consistent habit. Set a reminder or allocate a specific time each day, week, or month to add your designated amount to your savings container.

- Automate Your Savings: If you opt for a digital savings account, consider setting up automatic transfers from your checking account to simplify the process and ensure regular contributions.

- Track Your Progress: Keep track of your savings milestones and celebrate your achievements along the way. This will help you stay motivated and committed to the challenge.

- Adjust if Necessary: If you encounter financial hardships or unexpected expenses, feel free to modify the challenge to suit your circumstances. Saving any amount, no matter how small, is still a step in the right direction.