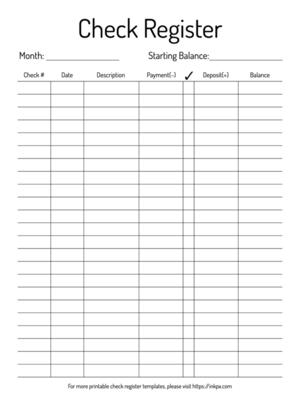

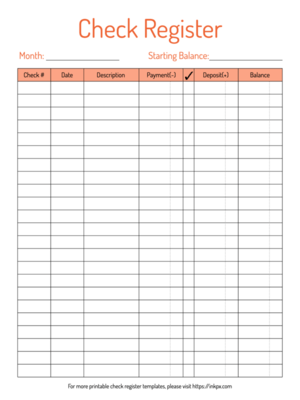

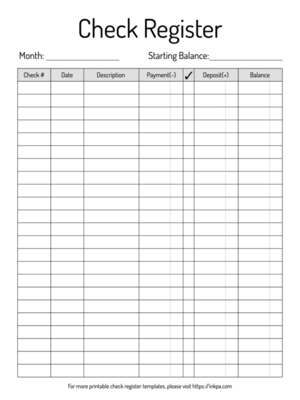

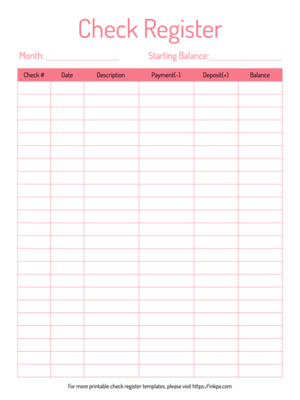

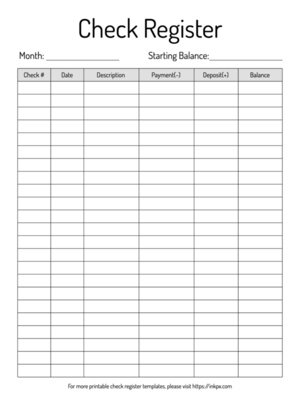

Check Register

Get organized with our downloadable printable check register! Available in PDF, PNG, and JPG formats, our easy-to-edit templates give you the freedom to customize fonts, colors, and add or remove text fields. Whether you prefer A4 or US Letter size, our check registers are designed to fit your needs. Simply download, print, and start managing your finances with ease. Stay on top of your transactions in style and never miss a beat with our user-friendly check register templates. Get started today and take control of your financial journey!

What is a Check Register?

A check register is a handy tool that helps you keep a record of your checking account transactions. It allows you to monitor your account balance, track deposits and payments, and maintain an accurate record of your financial activities.

What Does a Check Register Include?

A check register typically includes the following information for each transaction:

Check Number: If you write checks, the check register provides a space to record the check number assigned to each transaction. This helps you easily reference specific checks in the future.

Date: The date of the transaction is an essential detail to note in the check register. It helps you maintain a chronological order of your financial activities.

Transaction Description: In the check register, you can enter a brief description of each transaction. This description can include details about the payee or recipient, the purpose of the payment or deposit, or any other relevant information you wish to include.

Payment: For payments made from your checking account, such as writing a check or making an electronic transfer, the check register provides a space to record the payment amount. This allows you to track how much money you've spent.

Deposit: If you make deposits into your checking account, whether through cash, checks, or other means, the check register provides a designated area to record the amount of each deposit. This helps you track the money you've added to your account.

Balance: The check register includes a column for the balance, which is the remaining amount in your checking account after each transaction. It's crucial to update this balance accurately to ensure you have an up-to-date view of your available funds.

How to Use a Check Register:

To effectively utilize a check register, follow these simple steps:

Select a Template and Download or Print: Choose a check register template that suits your preferences or create one yourself.

Enter the Starting Balance: At the beginning of your check register, record the initial balance of your checking account. This balance should reflect the amount in your account before any transactions are recorded.

Track Payments and Deposits, Add Descriptions: For each payment or deposit, enter the corresponding date, payment or deposit amount, and a brief description of the transaction in the appropriate columns of the check register. Be sure to include enough details to help you remember the purpose of each transaction.

Calculate the New Balance: After recording each transaction, update the balance column by subtracting payment amounts and adding deposit amounts. This calculation will give you the new balance in your checking account after each transaction.

By consistently using a check register, you can maintain an organized record of your financial transactions, avoid overdrawing your account, and have a clear understanding of your available funds. It's a simple yet valuable tool that empowers you to stay in control of your finances.