Printable Budgeting Worksheets

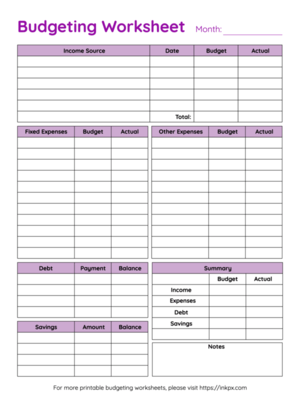

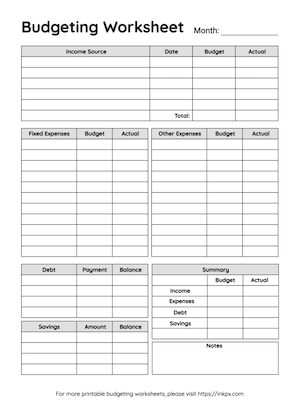

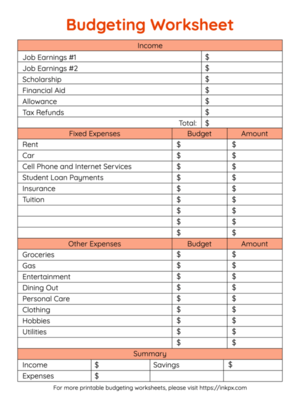

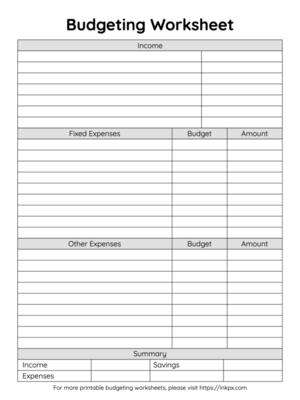

Discover a comprehensive collection of printable budgeting worksheets designed to empower you in managing your finances effectively. Available in PDF, PNG, and JPG formats, these worksheets offer the flexibility to download and print in your preferred A4 or US Letter size. Take control of your budget worksheet templates with ease by customizing fonts, colors, and adding or removing text fields to suit your specific needs. Simplify financial tracking and achieve your goals with our downloadable budgeting worksheets. Start your journey towards financial success today by accessing these user-friendly resources in just a few clicks.

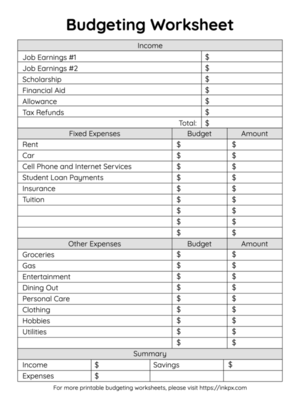

What is a Budgeting Worksheet

A budgeting worksheet is a tool that helps individuals and families organize and plan their financial activities. It is essentially a structured format for detailing income and expenses, aiding users in understanding where their money comes from and where it goes.

Types of Budgeting Worksheets

Different types of budgeting worksheets are tailored to different needs and lifestyles, including:

- Monthly Budgeting Worksheets: A standard budgeting worksheet that tracks all income and expenses on a monthly basis. It reflects the monthly financial cycle for most people and helps in monitoring regular spending patterns.

- Household Budgeting Worksheets: Designed for families or individuals living together, this type of budgeting worksheet takes into account the larger scope of household needs, from groceries to home maintenance costs.

- Student Budgeting Worksheets: Tailored for those in education, a student budgeting worksheet focuses on tuition fees, textbooks, living costs, and other education-related expenses, and often is adjusted to cover each term or semester instead of monthly.

What to Include on a Budgeting Worksheet

To create an effective budgeting worksheet, consider including the following sections:

- Income: List all sources of income, including salaries, wages, bonuses, and any side hustles or passive income streams. Good budgeting worksheets should distinguish between confirmed income and potential/variable income.

- Fixed Expenses: These are regular, unchanged monthly bills such as rent or mortgage payments, insurance premiums, and loan repayments. Fixed expenses are predictable and thus form the backbone of the budgeting worksheet.

- Other Expenses: This section captures variable costs such as food, transportation, and entertainment. While not as predictable as fixed expenses, they can be estimated based on past spending behaviors.

- Bills: Here, include all recurring payments that don't fall under fixed expenses, such as utility bills, credit card payments, and so on

- Summary: After listing all income and expenses, the summary section gives a quick overview or snapshot of the financial situation, highlighting the total income, total expenses, and the difference between them (which could either be surplus or deficit).

- Notes: Finally, a section for notes is quite useful for keeping track of financial goals, unexpected expenses, or changes in income. It can also be a space for reminders about when to review and adjust the budget.