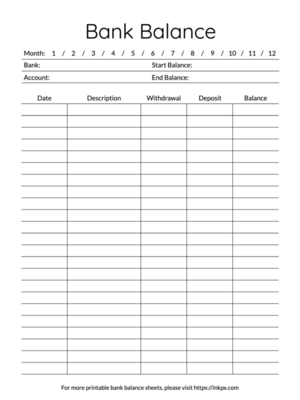

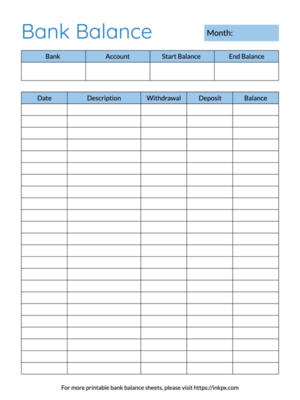

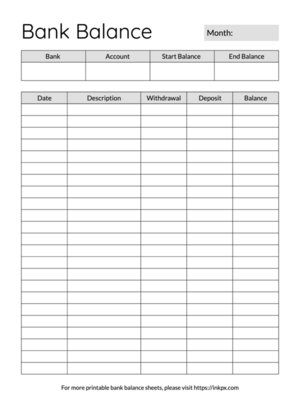

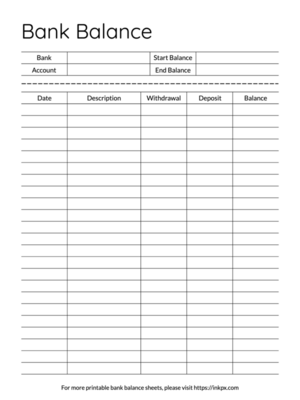

Printable Bank Balance Tracker Sheets

Manage your finances with ease using our printable bank balance tracker sheet templates, available for download in PDF, PNG, and JPG formats. Tailor them to your needs by customizing fonts, colors, and adding or removing text, ensuring they fit seamlessly into your financial planning routine. Opt for either A4 or US Letter size to suit your filing system, and gain control over your monetary matters with a clear, concise, and personalized financial snapshot.

What is a Bank Balance Tracker Sheet

A bank balance tracker template is a tool designed to help individuals or businesses monitor their financial transactions over a particular period. It typically includes fields to record deposits, withdrawals, the starting and ending balance, as well as other transaction details such as dates and descriptions. This template allows users to track their cash flow, ensuring that they have an accurate and updated record of their financial standing. By consistently updating a bank balance sheet, users can maintain better financial control, prevent overspending, and plan for future expenses or investments.

What to Include on a Bank Balance Tracker Sheet

To effectively track and understand a bank's financial health, a comprehensive balance sheet must include several key components:

- Bank: Identify the financial institution to which the balance sheet pertains.

- Account: The account being managed within the bank.

- Start Balance: State the initial amount of money present in the account at the beginning of the accounting period.

- End Balance: Note the final amount after all transactions have been accounted for during the period.

- Date: Include the specific date for which transaction applies, offering context to the data presented.

- Description: Provide details about each transaction on the account to maintain clarity and transparency.

- Withdraw: Record all sums of money taken out of the account, whether for payments, transfers, or expenses.

- Deposit: Log all amounts deposited into the account from various sources.

- Balance: Calculate and present the current balance after each transaction to keep an accurate running total.